The Coronavirus Aid, Relief and Economic Security Act (CARES Act)

The Coronavirus Aid, Relief, and Economic Security Act (CARES Act) was signed into law on Friday, March 27, 2020, and is the most massive economic relief bill in U.S. History. It will allocate $2.2 trillion in health care relief and emergency assistance for individuals, families, and businesses affected by the COVID-19 pandemic crisis.

Coronavirus Aid, Relief, and Economic Security Act (CARES Act)

The CARES Act was designed to distribute capital quickly and broadly. The Paycheck Protection Program (PPP) prioritizes millions of Americans employed by small businesses by authorizing up to $349 billion toward job retention and certain other expenses. Small businesses and eligible nonprofit organizations, Veterans organizations, and Tribal businesses described in the Small Business Act, as well as individuals who are self-employed or are independent contractors, are eligible if they also meet program size standards. (1)

Below you will find links to additional information, along with a few attachments, that may help covered businesses access the other resources available through the recently passed stimulus package:

Guidance from the U.S. Senate Committee on Small Business & Entrepreneurship

Guidance from the U.S. Chamber of Commerce

- Resources & Relief Info for Small Business

- What Small Businesses Need to Know

- Cares Act Small Business Guide & Emergency Loan Checklist

Guidance from the US Department of Treasury

The CARES Act also provides support for public transportation. To find out more information, please visit the Federal Transit Administration COVID-19 landing page.

Individuals & Families

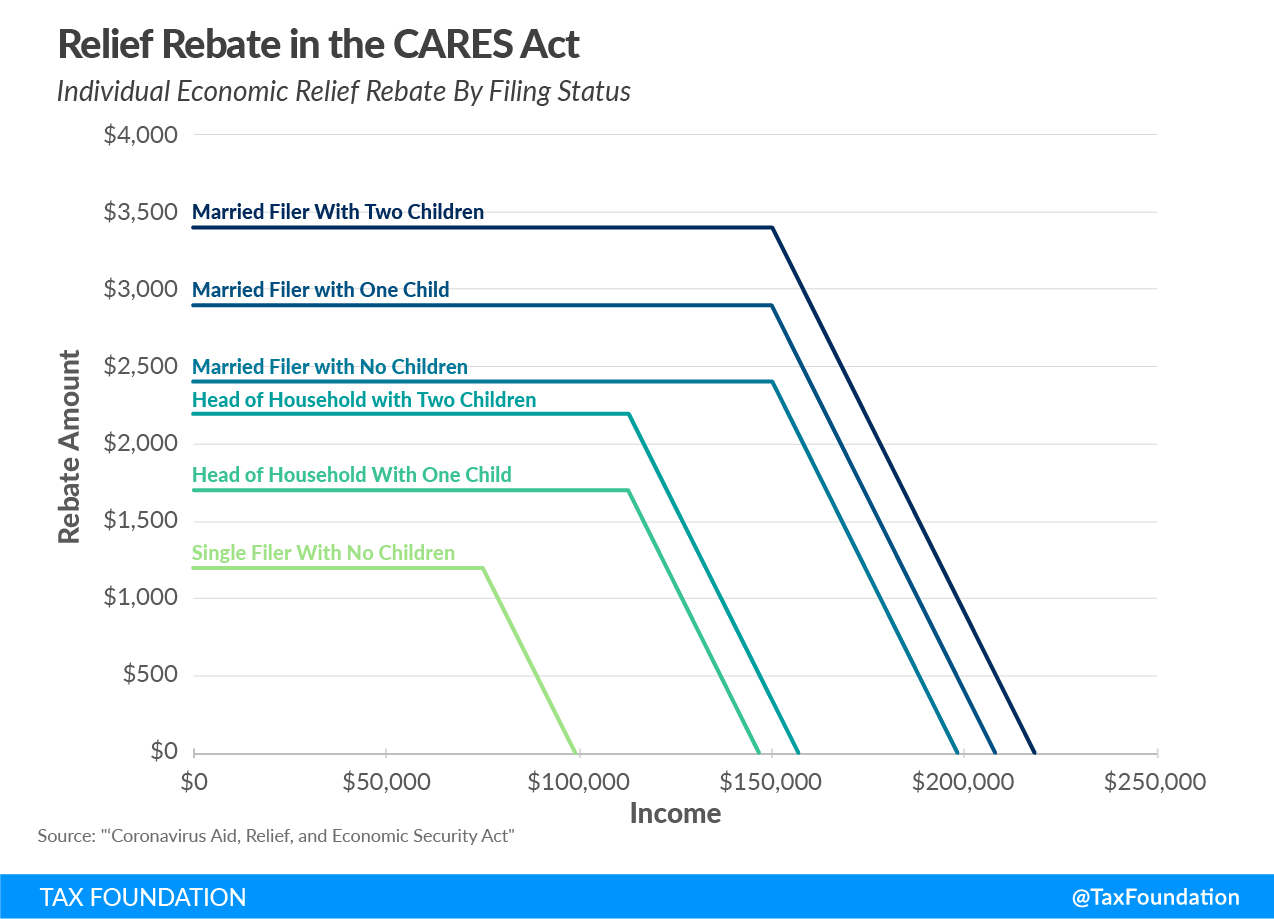

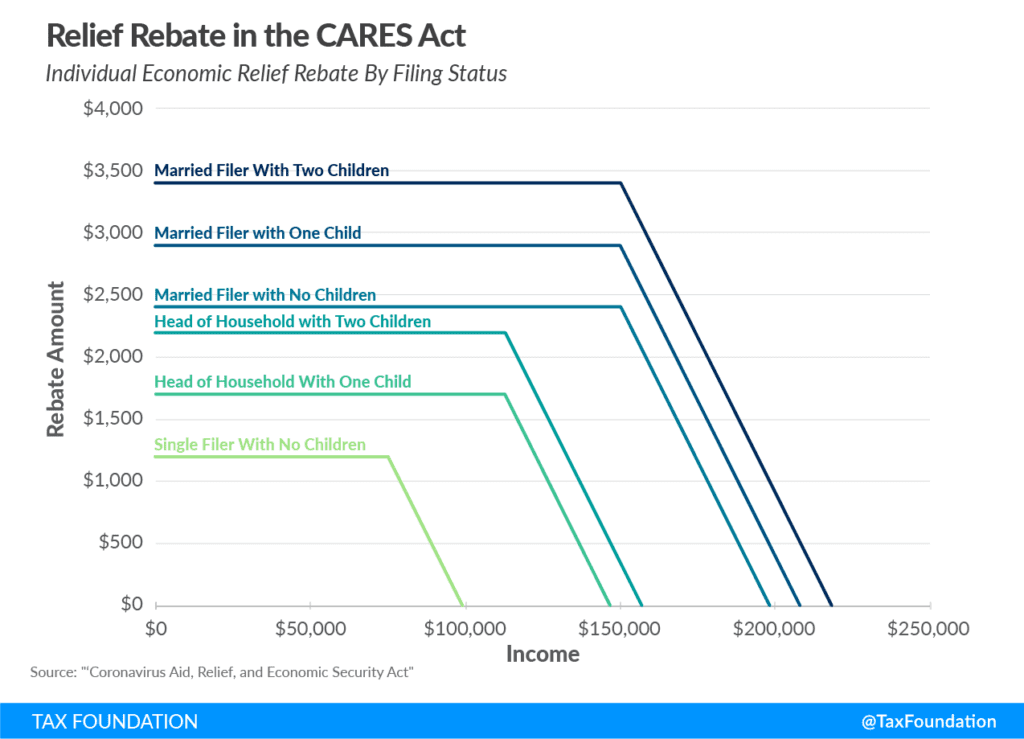

For individuals and families, $250 billion has been allocated for direct payments in the form of recovery rebates to help soften the economic challenges many are currently facing. Recovery rebates are refundable tax credits that will be applied to 2020 tax returns but will be advanced to taxpayers now based on their 2019 or 2018 adjusted income.

How much of a rebate will I receive?

Individuals with a Social Security Number (SSN) and who are not dependents may receive $1,200 (single filers and heads of household) or $2,400 (joint filers), with an additional rebate of $500 per qualifying child, if they have adjusted gross income (AGI) under $75,000 (single), $150,000 (joint), or $112,500 (heads of household) using 2019 tax return information. (The IRS will use 2018 tax return information if the taxpayer has not yet filed for 2019.) The rebate phases out at $50 for every $1,000 of income earned above those thresholds. (2)

How do I get my rebate?

For most Americans, no action is required. The IRS will use data from the most current tax returns or Social Security data to provide a rebate to Americans either via direct deposit (if such information is available) or through a paper check in the mail to the last address on file.

U.S. Treasury Secretary Steven Mnuchin said he hopes to distribute rebates to taxpayers who e-filed with direct deposit banking information in three weeks. Taxpayers receiving rebate checks may have to wait six to eight weeks to receive a paper check in the mail.

Treasury will be developing a web-based portal for individuals to provide their banking information to the IRS online. Taxpayers will be able to receive payments immediately as opposed to checks in the mail. (3)

Additional information regarding Rebate Relief, Social Security, Payroll Tax Changes, and Unemployment concerning the CARES Act can be found here:

Tax Foundation – FAQ on Federal Cornovirus Relief Bill (CARES Act).

Provisions of the CARES Act also address healthcare needs, expand individual access to retirement accounts, support education, and provide state and local governments with additional funds to help mitigate the on-going COVID-19 crisis.

- 401k

- Cares Act

- COVID-19

- covid-19 crisis

- COVID-19 financial assistance

- COVID-19 Relief Bill

- Department of Treasury

- economic relief

- education

- Families

- FAQ

- healthcare

- Individuals

- law

- Paycheck Protection Program

- retirement accounts

- Small Business

- Stimulus

- student loans

- The coronavirus aid relief and economic security act

- Unemployment

- US

- US Chamber