This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

2021 Property & Casualty Market Outlook

Explore the 2021 property & casualty market outlook with Crane Agency. Discover key insights, industry…

Re-Opening Guidance for St. Louis City & St. Louis County

Effective May 18th, St. Louis City and St. Louis County, in coordination with the Economic…

DOL Issues Emergency Extensions to COBRA

The U.S. Department of Labor’s Employee Benefits Security Administration (EBSA) today issued Frequently Asked Questions…

Reopening after the Shutdown, HSA/HRA/FSA Expansion, EEOC Updates, Preventing Burnout and more…

04.23.2020 Benefits Info Resources Newsletter (link) As you may know, a new federal law expands…

Workers' Compensation FAQ – NCCI COVID-19 Classification & Payroll Changes for Furloughed and Reassigned Workers

The National Council on Compensation Insurance (NCCI) has received numerous questions in the last few…

OSHA Considers Good Faith Efforts When Enforcing Compliance During Pandemic

U.S. Department of Labor | April 16, 2020 U.S. Department of Labor Considers Employer’s Good…

The Families First Coronavirus Response Act (FFCRA)

The Families First Coronavirus Response Act was signed into law on Wednesday, March 18, 2020. …

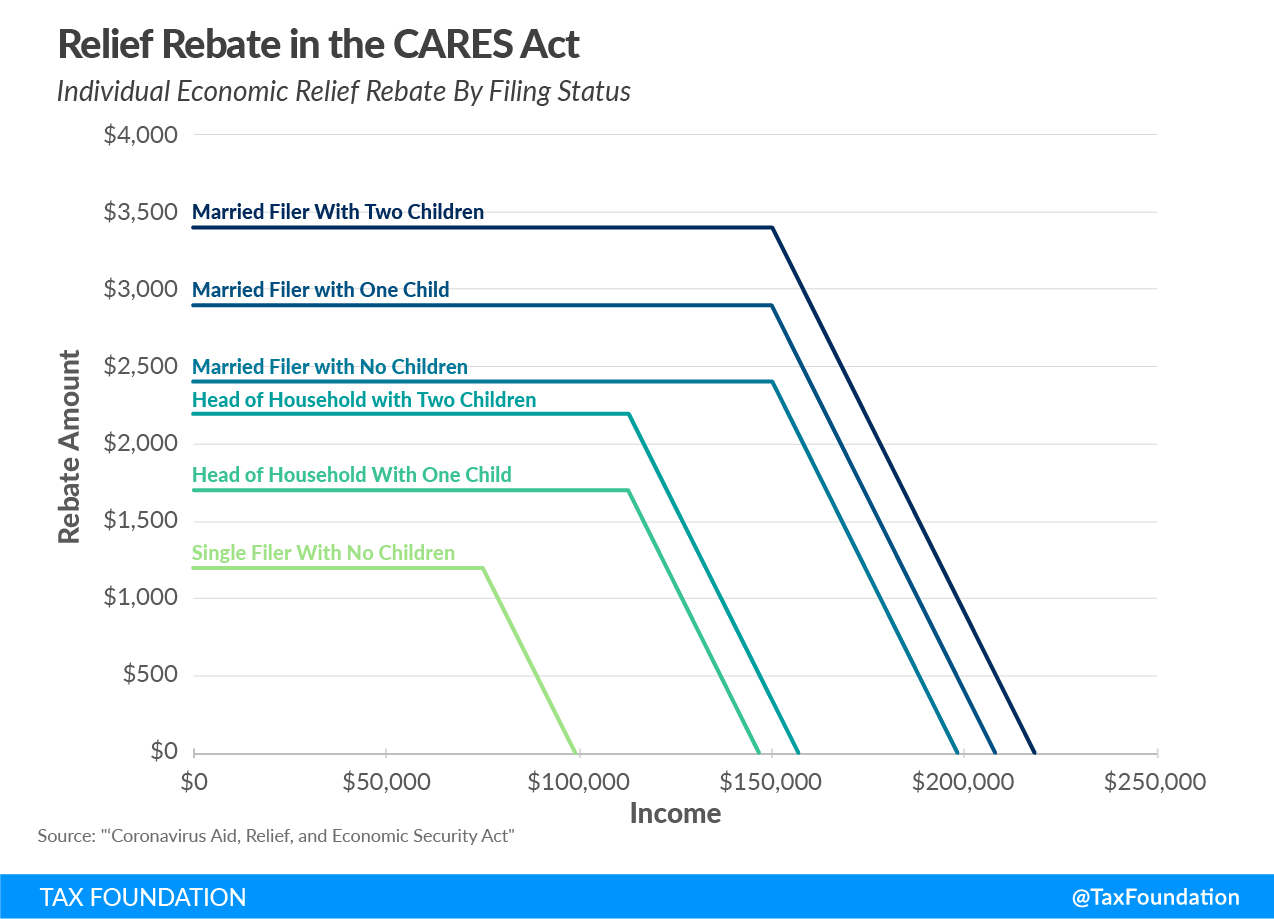

The Coronavirus Aid, Relief and Economic Security Act (CARES Act)

The Coronavirus Aid, Relief, and Economic Security Act (CARES Act) was signed into law on…

Coronavirus Preparedness Resources (COVID-19)

To help our clients stay informed, Crane Agency has created a Coronavirus Preparedness Resources page…

Understanding the $2 Trillion Stimulus Package, Managing Remote Employees and more…

03.27.2020 – Benefits Info COVID-19 Resources Newsletter If you need help understanding the 2 Trillion…

End of content

End of content

Insurance made simple.

Our newsletters deliver the insights you need to navigate the complexities of insurance.