This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

DOL Issues Emergency Extensions to COBRA

The U.S. Department of Labor’s Employee Benefits Security Administration (EBSA) today issued Frequently Asked Questions…

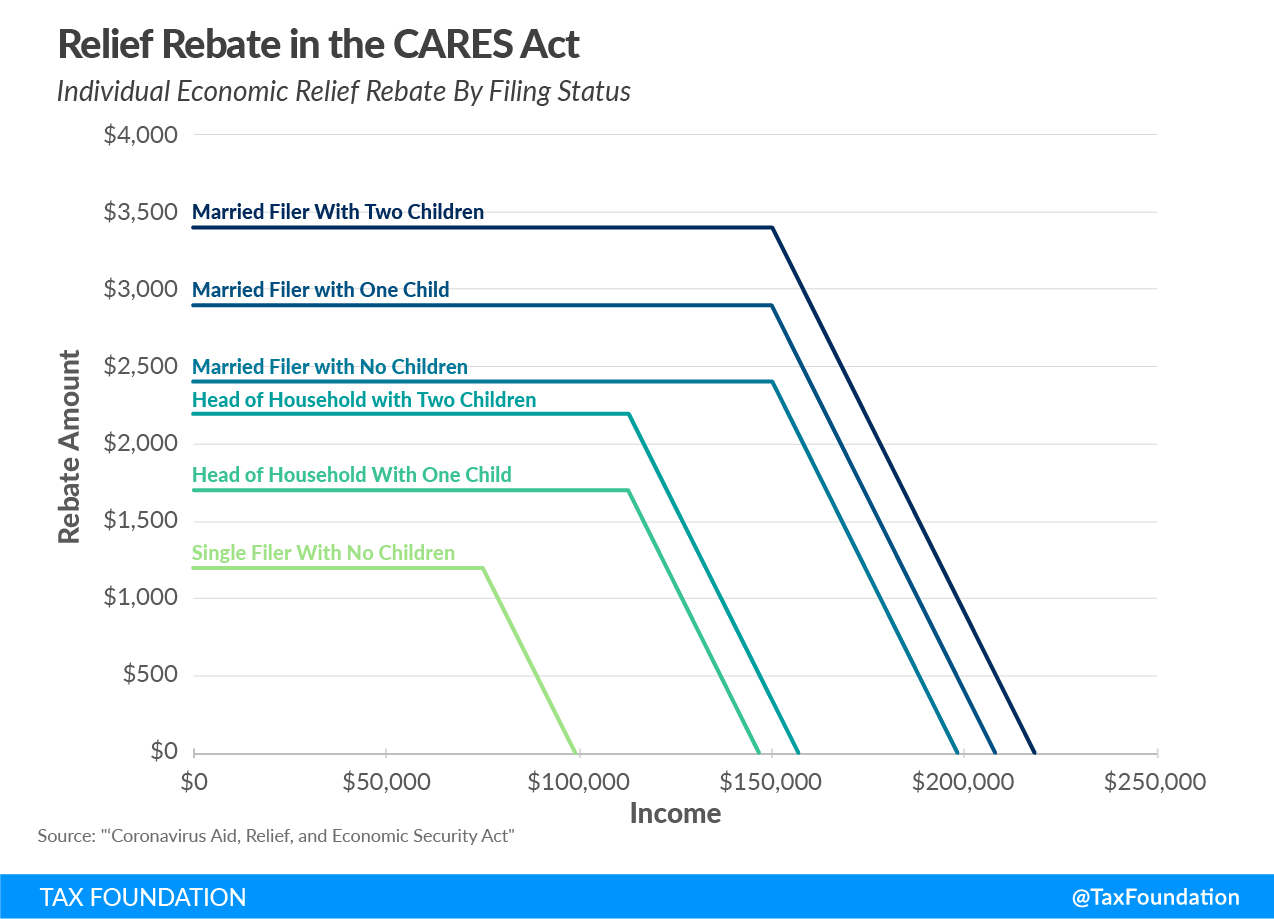

The Coronavirus Aid, Relief and Economic Security Act (CARES Act)

The Coronavirus Aid, Relief, and Economic Security Act (CARES Act) was signed into law on…

Understanding the $2 Trillion Stimulus Package, Managing Remote Employees and more…

03.27.2020 – Benefits Info COVID-19 Resources Newsletter If you need help understanding the 2 Trillion…

2019 Novel Coronavirus (COVID-19) FAQ UPDATED 3.24.2020

This UPDATED FAQ covers the general topic of COVID-19 virus to explain how various insurance…

2019 Novel Coronavirus (COVID-19) FAQ

03.24.2020 – Please see our updated FAQ for additional guidance, as it pertains to COVID-19.…

End of content

End of content

Insurance made simple.

Our newsletters deliver the insights you need to navigate the complexities of insurance.